Starting your own business in Dubai requires you to be aware of certain jurisdiction types to know which is suitable for your business activity. Registering your business can be complicated, however, the UAE accommodates every entrepreneurial structure and setup through three main economic jurisdictions; free zones, UAE mainland and offshore. With the first half of 2022 registering 25% more businesses than that of the same period of time in 2021, according to The National News, Dubai lives up to its reputation of being an active business hub. Depending on business activity, intended benefits, budgeted business costs as well as long and short-term objectives—you can choose between the three types.

It’s no doubt that the UAE is a gateway to business growth with its ‘zero-tax’ policies and bustling environment that promotes technology-infused business. Whilst setting up your business in such a location would guarantee a great ecosystem to work in, choosing your jurisdiction is contingent upon your business’s tailored requirements.

This blog intends on covering the following topics so that you can gain a thorough understanding of business registration in Dubai, including:

What Are Mainland, Free Zone, and Offshore Companies?

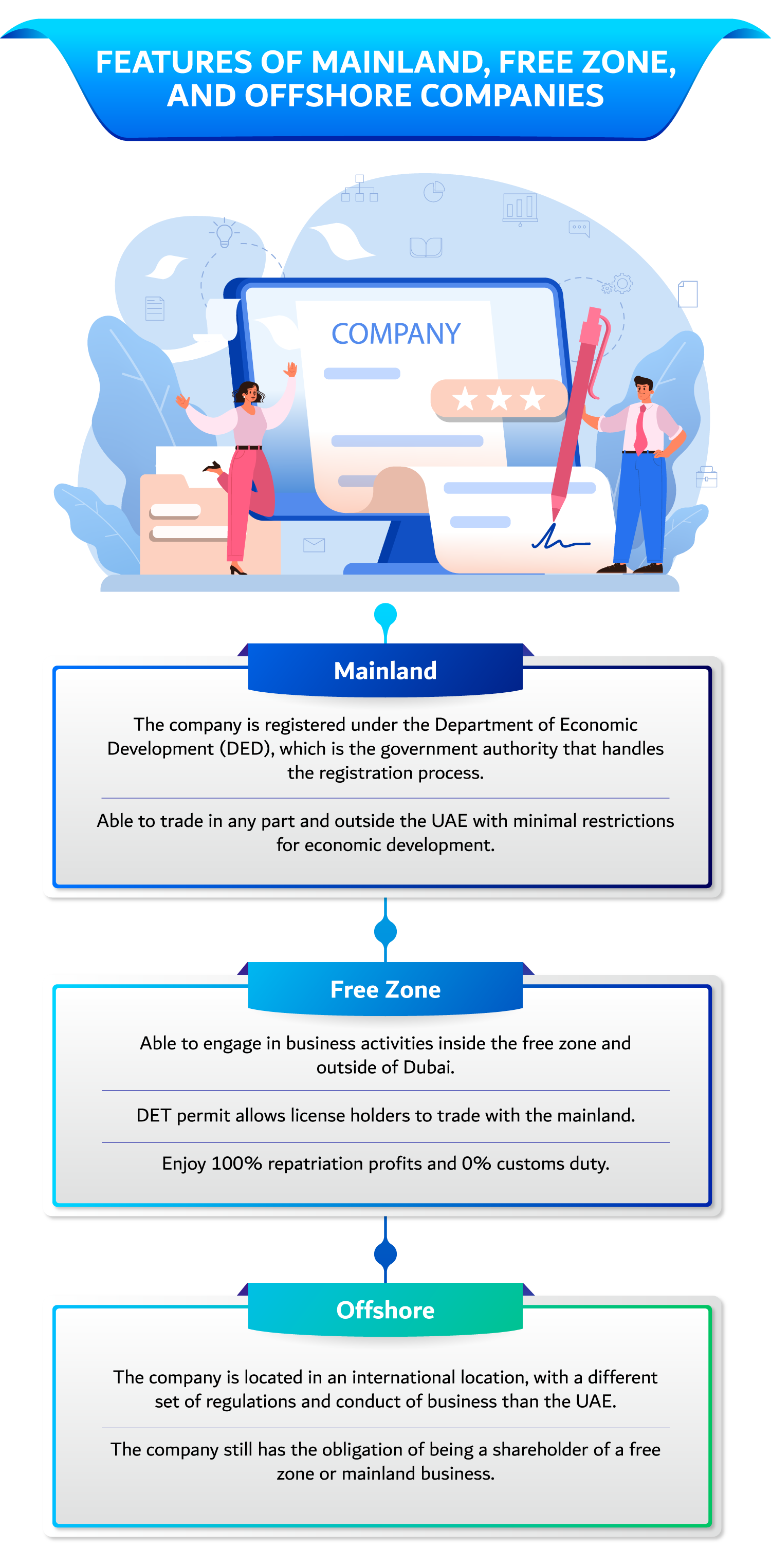

The three types of jurisdictions have a couple of differences along with their own benefits and drawbacks; it’s important to establish the definitions and main attributes of each to gather a proper understanding of registering your business.

- Mainland

Contrary to an offshore company, a business set up in the UAE mainland is deemed as an onshore company. The company is registered under the government authority which is the Department of Economic Development (DED) — the relevant emirate’s DED will resort to handling the registration process. A major point to note is that a mainland company is allowed to trade in any part and outside the UAE with minimal restrictions for economic development. - Free Zone

Dubai accommodates a large number of free zones to accelerate economic growth, and these unique jurisdictions pose their own regulations and governing bodies. Generally, you are only able to engage in business activities inside the free zone and outside of Dubai, whilst making use of 100% repatriation profits and 0% customs duty.Free zones like Meydan are abundant with technology, and innovative practices to encourage investment whilst being nestled in a highly professional setting. From the business registration process and licensing to hefty documentation — Meydan’s specialised panel of consultants are ever ready to help you gain a head start on your business venture. - Offshore

These companies are located in a different place from where the business owner lives and the business setup is in another jurisdiction than that of the UAE. In simpler terms, this means that the company is located in an international location — another country with a different set of regulations and conduct of business.Even though offshore companies operate outside of Dubai, the company has the obligation of being a shareholder of a free zone or mainland business.

Business Registration in Dubai

Business registration in Dubai requires an owner to follow a number of steps. Depending on the jurisdiction you choose, a local agent, free zone or mainland authority will assist you in the registration process. Here’s a general idea of what you must do:

- Determine Business Activity

It’s important to note which activities you want to pursue in your business. Whether it be consultancy, retailing, or freelancing, the jurisdiction you choose may determine the number of activities you can go ahead with. For instance, a free zone license generally allows you to choose from up to three core business activities. However, more recent developments allow up to 10 activities for one license.

- Decide a Company Structure and Name

Review various organisational structures, draw up strategies, and consider your day-to-day operations and business objectives when choosing to establish a sole proprietorship, partnership or LLC. Next, make sure you choose a trading name that abides by UAE regulations and doesn’t contain any offensive language.

- Approvals and Permits

If you are setting up your business on the mainland, it is vital that you receive trading name and business activity approval from DED and go through the relevant steps with government entities. Free zone companies need to communicate with the relevant authorities in their designated area, whilst the same applies to offshore companies located overseas.

After receiving the needed approvals, finalise fee payments associated with registration and launch your office space after receiving your trade license. Paying off compiled fees and finalising all processes with the help of a local agent or free zone authority like Meydan Free Zone would make receiving your trade license an easier process.

Set Up Your Business With Meydan Free Zone Today

A Detailed Comparison: Mainland vs Free Zone vs Offshore

There are quite a few variations between the economic jurisdictions that you need to take into account in order to choose the most suitable one for your business.

- Ownership

Previously, ownership for mainland companies didn’t receive full ownership—rather, only 49% would be owned by the company and the remainder of 51% in shares will be given to a local sponsor or authority in the mainland. As of recent events, UAE law allows non-Emiratis of all nationalities to own 100% of onshore companies established by them for more than 1,000 commercial and industrial activities, excluding economic activities with a strategic impact in seven sectors.

Free zone companies have full ownership of shares, including profits and title, whilst offshore companies are required to be located outside of Dubai in order to gain full ownership.

- Business Activities

Business activities for a company set up in the mainland can be easily conducted as these companies are able to engage in trade across all locations, abroad or locally.

For offshore companies, it’s mandatory to operate outside of the UAE to start your venture.

- Visa Requirements

For mainland businesses, the size of your work premise determines the number of visas that you could issue. Simply, it depends on the scale of your business and the number of employees you undertake.

For free zone companies, visa packages differ based on the jurisdiction, and in Meydan Free Zone’s case, you can allocate up to 6 visas.

With offshore companies that aren’t in need of any physical presence in the UAE, visa allocation is irrelevant.

- Capital Requirements

Mainland companies are codependent on legal and capital requirements, as the minimal capital requirement is solely based on the company’s legal structure. It depends on the activities carried out by the company.

For free zone companies, the minimum capital requirement is dependent on the emirate that governs the company.

On the other hand, offshore companies are void of any capital requirement.

- Legal Requirements

If you decide to set your company up in the UAE mainland, gaining initial approvals and permits to obtain a perfectly legal business license is a strenuous process. You will need permits from organisations like the DET and the Ministry of Labour.

Contrary to this, free zone entrepreneurs only need to adhere to the specific rules, regulations and simplified processes crafted by the free economic zone. At Meydan Free Zone, the process of obtaining your online business license is extremely straightforward, and a team of experts provides you with guidance throughout.

Offshore company formation is supported by several local free zones and agents in Dubai.

- Costs

The three jurisdictions incur costs different from each other. For instance, registering your start-up on the mainland can cost you AED 16,500 or more approximately for a trade license.

As for free zone companies, the costs are inherently lower compared to mainland set-up. With zones like Meydan Free Zone, you incur a lower company formation fee with licenses priced from AED 12,500 onwards.

Offshore companies are deemed to be the lowest with their costs in Dubai, starting with AED 12,000 only.

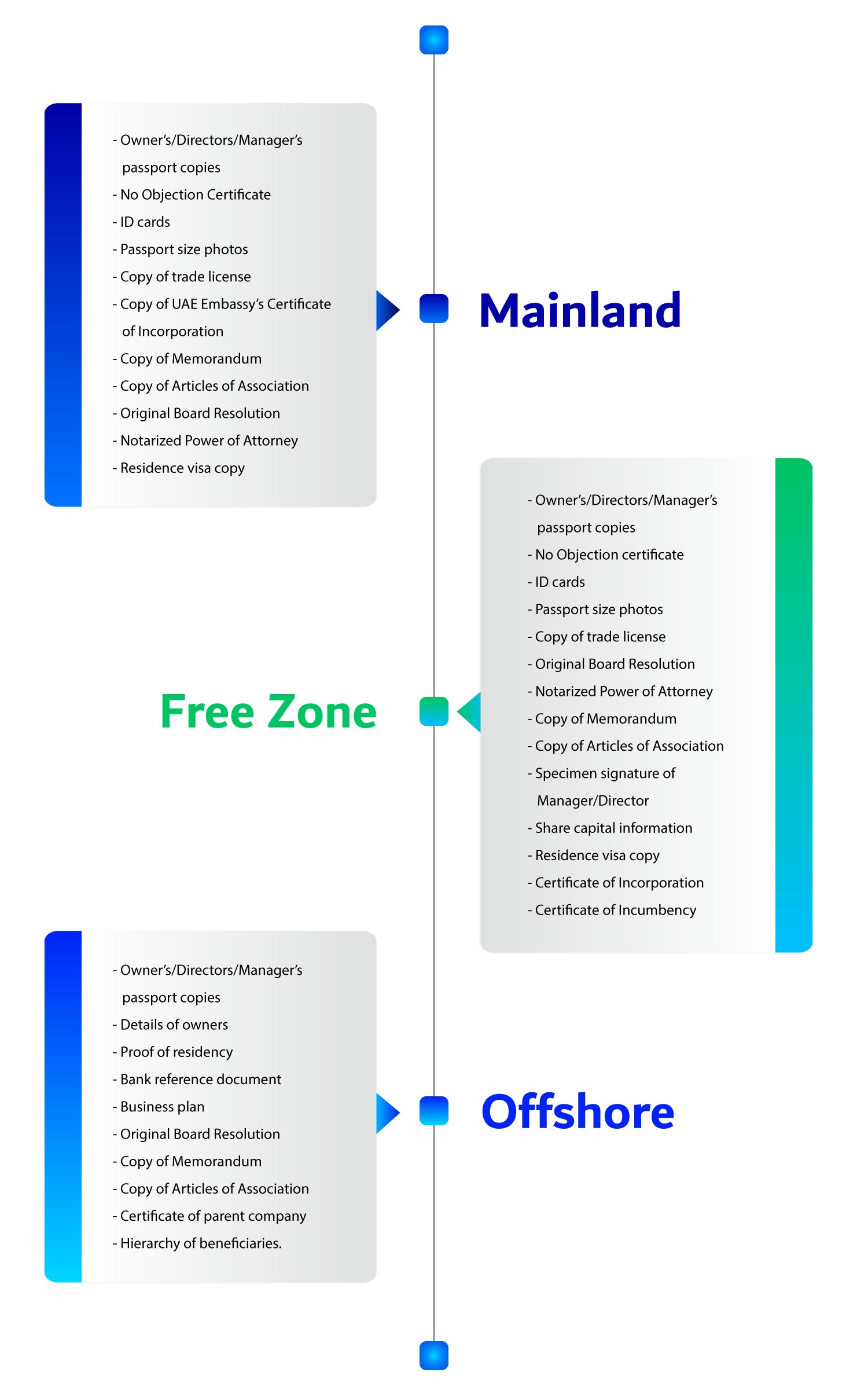

Documentation Requirements for Each Jurisdiction

Depending on the nature of the venture and the legal structure, the procedures and requirements for establishing a business frequently involve liaising with a number of institutions and bodies, both local and federal.

Most documents from countries other than the UAE must be notarized and legalised through diplomatic channels before being submitted to UAE authorities. Once legalised, corporate documents must usually be certified Arabic translations before they can be submitted, but the latter requirement does not apply to applicants for free zone licenses.

Which Jurisdiction is Suitable for You?

All three jurisdictions offer perks that would be viable depending on the legal structure and activities of the business. Therefore, being aware of the conditions and requirements that come with all three jurisdictions can be highly beneficial.

For example, if you want to make use of tax concessions and incur a lower set-up cost, free zones may be the choice for you. On the other hand, if you, as a business owner, prioritise protecting wealth and existing assets, an offshore company in Dubai may be the ideal choice.

Why Meydan Free Zone?

Meydan Free Zone is more than the eligible hub to set up your business in, with technology-infused services and digitalised registration processes—making sure your start-up has a competitive advantage. Located in the very heart of Dubai, surrounded by towering skyscrapers and outstanding transport systems, Meydan Free Zone is a hub that is bound to boost your business with its launch. Throughout the registration process, our team of experts is ready to heed and listen to every question and request to make sure the registration process is void of any error.