The UAE’s Economic Substance Regulations (ESR) were designed to ensure that businesses operating within the country have a genuine economic presence and are not merely tax shells. Therefore, ESR aims to stop non-domiciled directors who have registered (and who operate) companies in the UAE from evading tax in their home country. It’s an important step by the UAE to ensure the country is not blacklisted as ‘non-cooperative’ by the EU. In turn, it creates a better and fairer business environment.

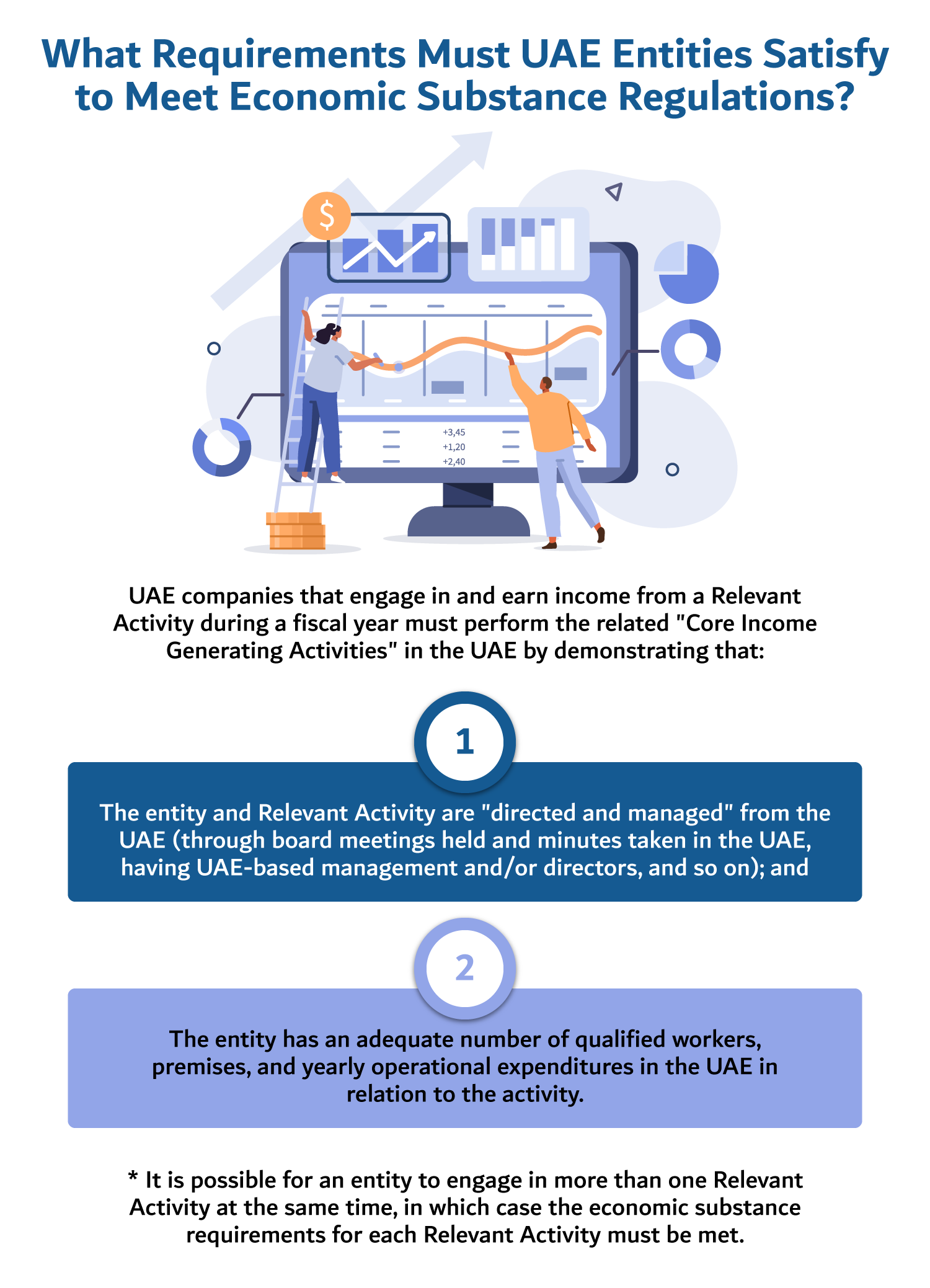

Regardless of how you’re setting up your business, it’s important that you’re aware of the UAE’s economic substance regulations. Essentially, your company needs to be managed or directed within the UAE, have an adequate number of UAE-based staff (who are full-time), generate the majority of your income in the UAE, as well as keep adequate assets in the UAE and be able to demonstrate operating expenditure in the country.

The rules initially came into effect back in 2019, with significant updates announced in October 2024. So, let’s break down what they mean for you. In this article, we will cover:

What is ESR UAE?

If this all feels a little overwhelming, we’ll break down what you need to know ahead of time in this article. In simple terms, ESR is defined as a set of standards that requires companies in the UAE to carry out business activities substantially in the country of their jurisdiction. The sole purpose of ESR would be to discard businesses with underlying intentions of registering their business to enjoy tax and economic benefits. In a country like Dubai, with highly favourable tax concession treatment, it’s logical that entities should establish stricter requirements to ensure sustainability in income generation.

Manage Your Business from Within the UAE

With the new economic substance regulations, your managing director (or one of your company’s senior management) has to be based in the UAE. That essentially means they operate from the UAE full-time, and it must be within the specific activity in which the company has been set up. The size of your business does not affect this requirement.

If your company has a board of directors, you must be able to show that there have been UAE-based meetings and that minutes have been taken from these meetings.

Employ Full-Time Staff in the UAE

In addition to requirements for management, you must ensure that your employees are physically present in the UAE. (This doesn’t apply to outsourcing)

Ensure Your Main Income is Generated Within the UAE

The work that your company does must be conducted from within the UAE. It’s acceptable if your clients are out of the country, but your key place of work should be the UAE.

Own Assets and Spend on Local Business Services

Your company needs to be spending an adequate amount of operating expenditure in the UAE. As with many of the regulations, it’s hard to gauge exactly how much or to put an exact figure.

When it comes to ownership of assets, it’s also a little unclear, but likely that assets will need to be declared.

It’s true that ensuring you comply with these regulations does take some thought and some work. It’s part of the UAE’s ensuring that it continues to be a global hub for business, attracting the most prestigious companies from around the world and being fertile ground for entrepreneurs.

Government Announcement

Understanding the UAE’s Economic Substance Regulations Update 2024

The UAE’s Ministry of Finance (MOF) has significantly relaxed its Economic Substance Regulations (ESR). Some of the key changes introduced by the recent update are:

- No more Notifications and Reports: Businesses operating in the UAE are no longer required to submit annual Economic Substance Notifications and Reports for financial years ending after 31 December 2022. This means a significant reduction in administrative burdens for businesses.

- Penalty Waivers and Refunds: Any penalties imposed for non-compliance with the ESR for financial years ending after 31 December 2022 will be waived or refunded. This provides significant relief to businesses that may have faced penalties due to inadvertent non-compliance.

The UAE has been working to align its tax framework with international standards, particularly those set by the European Union and the OECD. The initial ESR were introduced to ensure that businesses operating in the UAE have a genuine economic presence and are not solely using the country for tax avoidance purposes. However, after a review, the UAE government decided to ease the compliance burden on businesses. This decision was made in light of the introduction of corporate tax in the UAE, which already incorporates similar requirements for businesses to demonstrate economic substance.

Your Free Zone Options

Now is the time to take your business to a new level at Meydan Free Zone, an economic district that boasts one of the most prestigious addresses in the country, close to the key commercial and financial hubs of Dubai.

With a great mixture of investment and lifestyle benefits, you can live and work in Meydan’s premium mixed-use developments – offering high-quality office spaces and elegant lifestyle communities.

And it couldn’t be easier to get started. All your individual business needs can be met with a smooth registration process, tailored packages, and assistance on-hand.

Isn’t it time you started your new business journey with Meydan Free Zone?

FAQ 1: What are Economic Substance Regulations in the UAE?

Economic Substance Regulations (ESR) are a set of guidelines that ensure companies with substantial economic activities in the UAE maintain an adequate presence in the country. These regulations applied to UAE onshore and free zone companies engaging in specific ‘Relevant Activities’, promoting economic transparency and discouraging tax evasion.

FAQ 2: Who has to comply with ESR in the UAE?

Previously, local companies in the UAE—whether located in free zones or onshore—and any resident business entities engaged in Relevant Activities were required to submit an Economic Substance Notification and, if applicable, an Economic Substance Report. However, as of Cabinet Decision No. 98 of 2024, the requirement to file these reports has been eliminated for businesses with financial years ending after 31 December 2022.

FAQ 3: Is ESR filing still mandatory?

Previously, filing for ESR was mandatory if a business generated income or revenue from the Relevant activity under ESR regulations. However, as of 14 October 2024, businesses conducting Relevant Activities in the UAE, with financial years ending after 31 December 2022, are no longer required to submit an Economic Substance Notification or an Economic Substance Report.

FAQ 4: What happens to previous ESR fines?

According to the latest Cabinet Decision, all fines issued for ESR non-compliance in financial years ending after 31 December 2022 will be cancelled. Additionally, companies that had paid penalties for non-compliance during this period are eligible for refunds, which the Federal Tax Authority will process.