As one of the world’s most thriving hubs for both technology and financial services, it is no surprise that the UAE is at the centre of the region’s fintech industry.

Fintech is essentially the integration of technology into financial products and offerings. The aim is to improve the user experience for customers and staff alike – and right now, it’s big business in the UAE.

The fintech industry in the Middle East grew at a CAGR of 30% last year. Next year, it is estimated that the UAE will account for around USD 2bn in investment in the space. That’s a significant increase of USD 80m in 2017.

Adding to the draw of the UAE is the ease with which you can start a fintech company out here. With the support of the experts at Meydan Free Zone, your business can be up and running within days.

What Is a Fintech Company?

Fintech companies are companies that provide the full range of financial services typically provided by traditional banks, with the difference that technology is used to modify, enhance, or automate financial services for consumers or businesses. Some examples are mobile banking, peer-to-peer payments, automated portfolio managers, and trading platforms. Cryptocurrencies can also be developed and traded using this method.

Advantages of Starting a Fintech Business in Dubai, UAE

Perhaps the biggest benefit to fintech entrepreneurs in the UAE right now is the market need. Some 70% of people across the GCC are regular smartphone users, a major driver behind the 30% growth in mobile payments in recent years.

The UAE’s tech-savvy population has an appetite for digital services, and the growth potential is at its biggest in the more traditional banking space.

On top of this, the UAE’s attractive tax rate remains at 0% of personal income. And when you set up in a free zone, you’ll also benefit from zero currency restrictions, plus profit and capital repatriation.

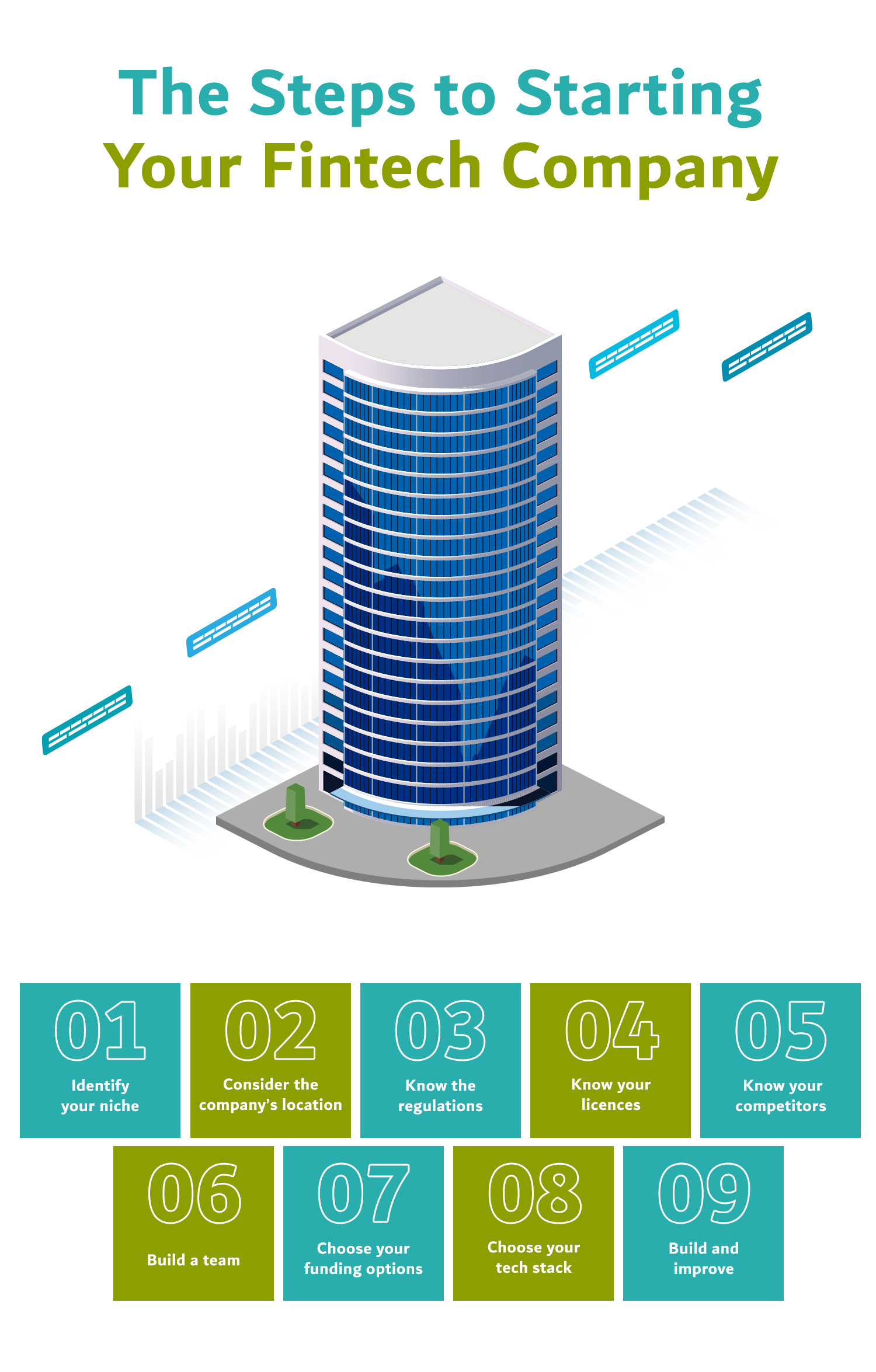

Steps Involved in Starting a Fintech Company

There are several equally important aspects to keep in mind as you decide how to start a fintech company. When you put together an agile business plan for initiating a fintech startup, you can focus on the most relevant aspects and then experiment and add your own unique touch to the project. Read on to identify some of the steps involved in starting a fintech company.

1. Identify your niche

The fintech industry is broad, so there are many gaps that need to be filled. It is important to begin small and grow to solve other problems as you go, as solving too many problems at once will lead to failure. Therefore, identify your niche and work with that.

2. Consider the company’s location

It is necessary either to create the startup in a physical location, online or both, after understanding the problem and target customers. This is due to the fact that particular businesses may opt to start out as remote or physical offices.

3. Know the regulations

In order to launch a startup that is globally accessible, you need to understand various laws and how they will impact your company. These laws include labour laws, corporate profits, and data use laws. Since the fintech and banking industries are highly regulated, it is important to know their ins and outs.

4. Know your licenses

Licenses are documents issued by governments that permit people to work in finance legally, and depends on your niche sector. It is important to consider price, preparation work, and the range of services you can provide before choosing a license.

5. Know your competitors

If you are offering a new product, it should address a specific gap in the market. It is also possible to improve what already exists instead of introducing something new.

6. Build a team

You will have to hire a team of experts, or outsource services such as app development. There are only a few startups with more than three co-founders, most of which have one to two co-founders. In order to create the minimum viable product or scale a company, a founding team is crucial

7. Choose your funding options

Fintech startups can raise money in a variety of ways. Among them are crowdsourcing, bank loans, venture capital, angel investors, and startup competitions.

8. Choose your tech stack

To put together the right technology stack, you need to keep in mind that good things aren’t always fast and cheap. To choose the right technology, you should consider third party out-of-the-box solutions, serverless architecture, rapid development tools, good documentation, a large community, and collaboration with an experienced development team.

9. Build and improve

As this process continues, it will extend into the future. Rather than rushing into this highly competitive and saturated market, it is best to start small and keep improving your product. During this process, you will launch your startup, start its operation, improve its processes and products, adopt new technologies and trends, and embrace change as it happens.

Steps to Get a Fintech License in Dubai, UAE

Before embarking on the UAE company process, the best place to start is by consulting with a local business expert.

When you start your business with Meydan Free Zone, you get the benefit of our expertise so you can go into the company formation process with total confidence. Your dedicated account contact will guide you through the following company formation process.

Step 1: Choosing a company name

First, we’ll help you choose and register your company name. The UAE has a set of naming parameters that you’ll need to stick to. But don’t worry, all are straightforward and largely common sense.

Essentially, you should avoid blasphemous and offensive language and names of well-known organisations. There are also a few more rules which we will cover in your initial consultation.

Step 2: License application

Next, we’ll help you apply for your fintech license. At this stage, you’ll need to provide some details about your business and its shareholders, as well as proof of address and identification.

When you set up with Meydan Free Zone, we’ll make sure you are appropriately licensed to operate in the financial industry. As any financial trading is heavily regulated in the UAE, this means gaining approval from the Financial Services Regulatory Authority (FSRA).

Depending on the exact nature of your business, you may also require additional approvals from government and industry bodies.

Step 3: Getting your visa

Finally, we can help you with your visa application and assist with the opening of your corporate bank account.

As part of the visa application process, you will need to undergo a fitness test, blood test, and chest x-ray. You can also sponsor the visas of others such as dependent children and parents, your spouse, and any domestic staff.

Cost of a fintech license in Dubai, UAE

Costs for starting a fintech business in the UAE start in the region AED 12,500-35,000 inclusive of formation and application costs

However, total final costs will depend on many factors, including the size, nature and location of your business.

More often than not, starting your business in a free zone is more cost-effective than setting up in the mainland.

Operating in a free zone also allows you to take advantage of virtual and flexi-desk packages as well as coworking facilities and other business support services.

For a detailed and personalised breakdown of the costs involved in starting your fintech business, get in touch with the team at Meydan Free Zone.

Why work with Meydan Free Zone

Meydan Free Zone is a thriving, centrally located economic district with one of the most prestigious business addresses in the region.

We offer our businesses a host of innovative investment and lifestyle benefits in a secure regulated environment that empowers productivity. And we can help you join them too. When you set up here, you’ll benefit from:

A business presence in the heart of Dubai

You’re never far from the hustle and bustle of the city centre at Meydan Free Zone. Just 15 minutes from the Dubai International Airport and mere minutes from Downtown Dubai.

An empowering environment

Setting up your business in Meydan Free Zone gives you exclusive access to a networking community that inspires growth through innovation and collaboration. Dubai is home to countless startups, SMEs, and multinational corporations, making it the perfect city for you to start and grow your business.

A paperless experience

Don’t let red tape hold you back. Our intelligent and intuitive license application kit means you will work with easy-to-use forms that significantly reduce time and effort during the application process. The platform brings together all aspects of compliance and regulation for your businesses in a single interface.

Our expert team can assist across all processes involved in business setup in Dubai, from registering your company name to managing your license and visa applications.

To find out more, visit our website, or get in touch with us via setup@meydanfz.ae or 800FZ1.

If you prefer, you can visit us at Meydan Free Zone Business Centre, Mezzanine Floor, Meydan Hotel, Meydan Rd, Nad Al Sheba 1, Dubai, UAE.

FAQ 1: What is a fintech start up?

A fintech startup is a startup that employs (typically mobile) technology to provide a financial service. Fintech apps are those that enable users to bank, pay, save, spend, invest, borrow, or make money through digital payments, digital lending, digital banking, digital investment, and consumer finance.

FAQ 2: Is fintech in high demand?

Yes, the fintech sector is growing rapidly, and it has created a wide range of job opportunities for individuals with a strong understanding of its technical aspects.

FAQ 3: What do you need to launch a fintech startup?

Though profit margins may sometimes be slim without large amounts of capital coming in, investing in a small business normally pays back far more than you may expect. Before starting your business, you need to know that investing in a small business provides you with many avenues for business growth, is less stressful, saves time and allows you to focus on what you do best!

FAQ 4: What Are the Advantages of Starting a Fintech Company?

- Customers are increasingly interested in Fintech solutions due to its high adoption rate.

- The availability of a variety of technologies enables effective and relevant solutions to be created.

- Fintech is being incorporated into major industries due to its numerous uses both internally and externally.