The United Arab Emirates is the biggest regional hub for startups – the UAE is home to over a third (35%) of all new startup companies in the MENA region, according to Statista. You will need a banking solution for your startup to get funding, pay staff, and receive payments from customers.

However, as discussed in a recent Hub71 startup finance roundtable, getting access to banking has often been tricky for new companies in the UAE. Fortunately, however, this is changing, and as our banking 101 for startups in the UAE shows, new solutions are emerging to make managing your company’s money easier.

In this blog you will learn about:

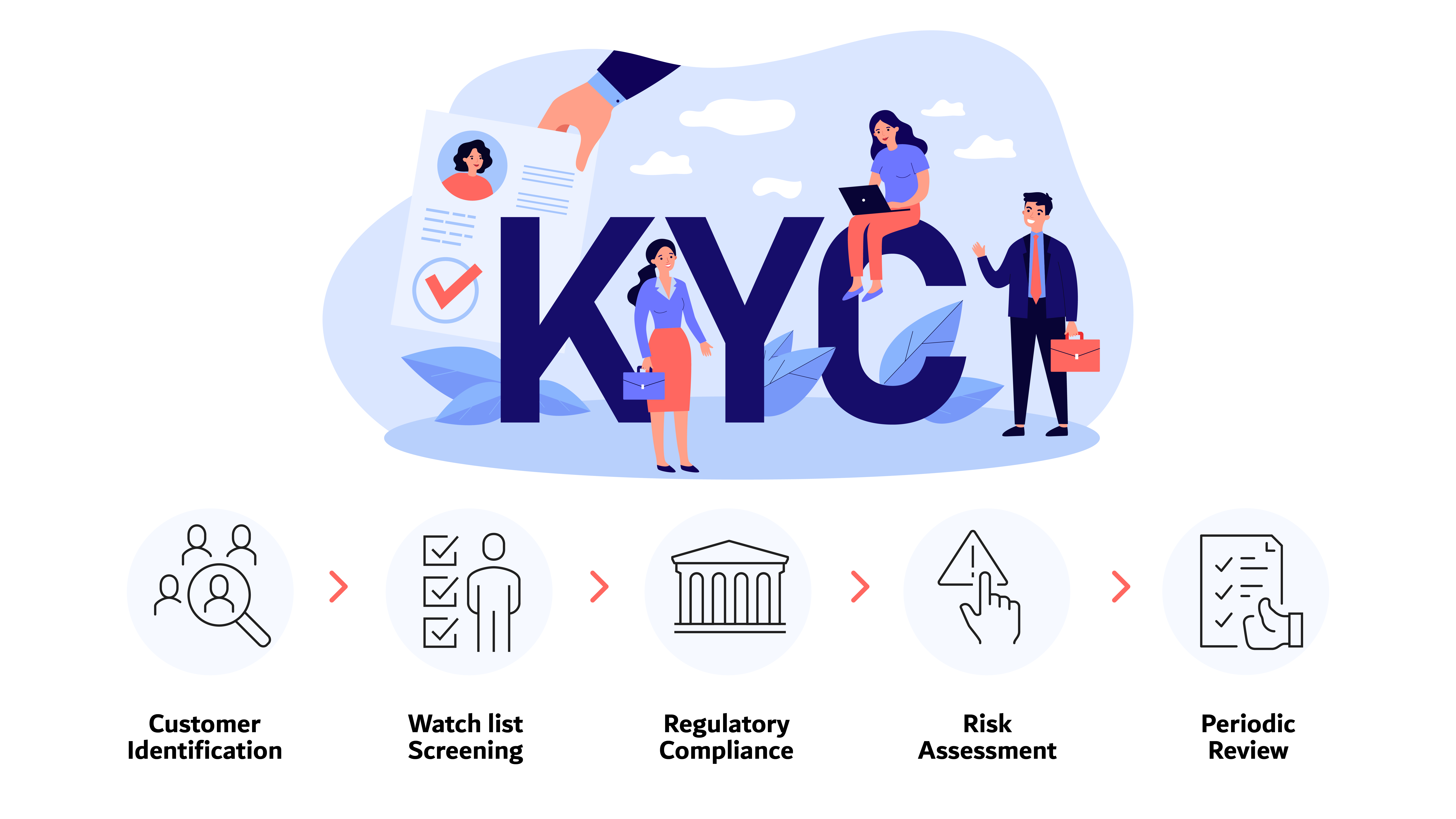

What Is KYC, And Why Is It Important?

KYC, which stands for ‘know your customer, is a set of global standards that financial services companies are encouraged to follow. Knowing your customer is to encourage banks, credit providers, accountancy businesses and other financial service providers to perform background checks on the people using their services and depositing money with them.

KYC is intended to help with:

- Making it harder for criminals to use the banking sector to store proceeds of crime

- Make it more difficult to use banks for money laundering

- Reduce the risks of fraudulent activities

- Clamp down on tax avoidance

- Tackle terrorism finance

- Avoid reputational damage for banks

Knowing your customer is important because many governments around the world – including the UAE – want to tackle illegal behaviors by making it harder for criminals to use the banking system. KYC is an effective tool for tackling financial crime, so banks are encouraged to use it during their onboarding processes. Failing to perform KYC could lead to fines or reputational damage for banks and other financial services businesses. In the UAE, KYC is mandatory.

If you are a startup in the UAE, the country’s banks will require you to undergo their KYC process when applying for an account. This involves providing detailed information about who you are, your funds, and how your business works. While it may at first appear onerous, for legitimate businesses complying with KYC is usually very straightforward. It also means that your customers and investors can have more trust in your business, as you have demonstrated that you are a legitimate company.

Documents Required To Open A Business Bank Account In The UAE

Here are the basic documents required to open a bank account in Dubai, UAE. Opening a business bank account in the UAE for startups is typically fairly straightforward, although it can be useful to work with a local partner who understands the process and can guide you through the steps involved. To open your UAE business bank account, you will need to collate the following kinds of documents:

- An identity document – such as an Emirates ID card or a valid passport with a residence visa

- A CV which describes your professional background – some banks require you to show several years of professional experience before opening a business bank account.

- A utility bill to prove your current address – must be dated from the previous three months.

- Your UAE business’s founding documents, including free zone license

- A personal bank statement for all shareholders and, if applicable, corporate bank statements for the previous six months

- Evidence of proof of ownership of your business

- A business plan which includes information about your clients, activities, financial plan and profit and loss projections

Sometimes banks may request further information as part of their KYC process. At Meydan Free Zone, our consultants can advise you on all the documents you’ll need to open your Dubai business bank account.

OPEN YOUR BANK ACCOUNT WITH CBD

Cost Of Opening A Business Bank Account In Dubai, UAE

Banks in the UAE do not charge you any money to open a business bank account. The UAE’s banks are very business-friendly and want to encourage entrepreneurship – so there are rarely any charges for opening the bank account itself.

That said, many banks will have minimum monthly balance requirements or minimum monthly payments, so it is important to ensure that you will be able to meet these going forward. The minimum monthly balance can range from AED 50,000 to AED 500,000, so it’s vital to ensure you’ll be able to meet these minimums. Failure to do so could lead to fines from the bank. You might also need to meet a minimum opening balance deposit.

If you’re unsure, our consultants at Meydan Free Zone can advise you on the minimum monthly balance for any banks you’re interested in working with.

OPEN YOUR BANK ACCOUNT WITH WIO

Why Do Entrepreneurs Choose Meydan Free Zone?

Meydan Free Zone is a startup-friendly business hub located in the centre of Dubai, close to the airport and business districts. We host numerous innovative startups working in a wide range of industries in the free zone, providing them with payment solutions that make it easy to get their business up and running and receive funds from customers. You’ll also benefit from excellent technical support, 24/7 access and attractive, modern offices.

Our friendly and experienced consultants can support you with every step of business setup in Dubai free zones, and we also offer solutions for e-commerce licenses in Dubai, Additionally, our Easy Payment Plans make it easier for you to manage your startup costs.

If you are looking for a payment solution and free zone for your startup, contact Meydan Free Zone to begin your business journey today.