Topic Summary

The introduction of corporate tax in the UAE marks a pivotal transformation in the nation’s fiscal landscape. This measure is designed to harmonise the UAE with global tax standards while safeguarding its reputation as an attractive business hub. The corporate tax regime balances competitiveness with regulatory compliance, creating a dynamic environment for businesses of all sizes. Here are five key aspects to understand about the UAE corporate tax in 2025:

1. Scope and Applicability

Corporate tax applies to all businesses operating in the UAE, including mainland companies, free zone entities, and foreign branches, with specific exemptions for certain sectors. It is important to note that businesses with annual profits below the prescribed threshold may benefit from a zero-tax rate, supporting SMEs and startups in thriving without excessive tax burdens.

2. Tax Rates and Thresholds

The standard corporate tax rate is set at 9% for taxable profits exceeding AED 375,000 (approximately USD 102,000), while profits below this threshold are taxed at 0%. This progressive structure encourages business growth while maintaining fiscal responsibility. Free zone entities meeting regulatory requirements generally continue to enjoy favourable tax incentives.

3. Filing Requirements and Deadlines

Businesses are required to maintain accurate accounting records and submit tax returns annually to the Federal Tax Authority (FTA). The deadline for submitting corporate tax returns is within nine months of the end of the financial year. Early preparation and adherence to these requirements are crucial to avoid penalties and ensure compliance.

4. Transfer Pricing and International Compliance

The UAE corporate tax regime includes transfer pricing rules aligned with OECD guidelines to prevent profit shifting and tax base erosion. Multinational enterprises must prepare and document transfer pricing policies, ensuring transactions between related parties comply with arm’s length principles. This enhances transparency and supports the UAE’s commitment to international tax standards.

The introduction of corporate tax in the UAE marks a major shift in how businesses operate, plan finances, and manage compliance.

Designed to align the UAE with international tax standards while preserving its business-friendly environment, the corporate tax regime remains one of the most competitive globally.

Whether you are a startup founder, SME, or multinational expanding into Dubai, this guide will help you understand the corporate tax rate in UAE, who it applies to, how it is calculated, and what it means for companies operating in free zones like Meydan Free Zone.

Understanding Corporate Tax in the UAE

Corporate tax in the UAE is a federal tax imposed on the profits of businesses and corporate entities.

It was officially implemented starting from June 2023 and is applicable across all emirates.

The tax applies to:

- UAE-incorporated companies

- Foreign companies with a permanent establishment in the UAE

- Individuals conducting commercial activities under a business license

Corporate Tax Rate in the UAE

As of 2025, the corporate tax rate in the UAE is structured as follows:

- 0% tax on taxable income up to AED 375,000

- 9% tax on taxable income exceeding AED 375,000

- A different rate may apply to large multinational corporations under OECD Pillar Two rules (not applicable to SMEs)

This structure supports small businesses and early-stage companies while ensuring larger corporations contribute to the national economy.

Corporate Tax in Dubai and Across Emirates

Corporate tax in Dubai is governed by federal legislation, meaning the same tax rates and rules apply across all emirates.

Businesses in Dubai are subject to the same compliance, registration, and reporting requirements as those in Abu Dhabi, Sharjah, or any other emirate.

However, each jurisdiction may differ in terms of local business licensing, free zone incentives, and support structures.

For example, as a Qualified Free Zone, Meydan Free Zone offers built-in guidance on corporate tax registration and a 0% corporate tax exemption for QFZPs.

Corporate Tax in UAE Free Zone Companies

The UAE has made specific provisions for free zone company tax rules.

Free zones like Meydan Free Zone are designated as Qualified Free Zones (QFZ) under the UAE corporate tax framework.

This means that eligible businesses in Meydan Free Zone may benefit from a 0% corporate tax rate, provided they meet all qualifying criteria:

- Income is earned from outside the UAE or from other free zones

- No income is earned from the mainland without proper structuring

- Tax returns are filed annually

- The company is registered with the Federal Tax Authority (FTA)

Corporate tax in UAE free zone companies is based on qualifying vs non-qualifying income.

Non-qualifying income (such as mainland sales) may be taxed at 9% unless structured correctly.

Latest News and Regulatory Information of Corporate Tax in the UAE

As of 2025, the latest news about corporate tax in the UAE confirms that:

- All UAE-licensed businesses must register with the FTA

- Taxable persons must file annual returns, even if no tax is due

- Transfer pricing rules apply to related-party transactions

- Small business relief may be claimed if revenue is below a specified threshold

- Free zone businesses that do not meet QFZ criteria will be taxed on total profits

Meydan Free Zone ensures its licensed entities receive updated compliance guidance to remain tax-efficient and aligned with FTA regulations.

Corporate Tax Exemption in the UAE

There are several scenarios where a business may qualify for a corporate tax exemption in the UAE:

- If annual taxable income is under AED 375,000

- If the business is based in a Qualified Free Zone and earns only qualifying income

- If the entity is a government body, public benefit organisation, or an approved investment fund (subject to FTA validation)

However, even exempt entities must register and file annually.

Calculation of Corporate Tax in the UAE

Here is a basic example of corporate tax in the UAE calculation:

If your business earns AED 800,000 in annual taxable profit:

- The first AED 375,000 is taxed at 0%

- The remaining AED 425,000 is taxed at 9%, resulting in AED 38,250 in tax

However, if you are a QFZP entity and all income qualifies under the exemption rules, your effective tax may be 0%.

Meydan Free Zone can assist with entity structuring to optimise for corporate tax and guide you through accurate financial reporting.

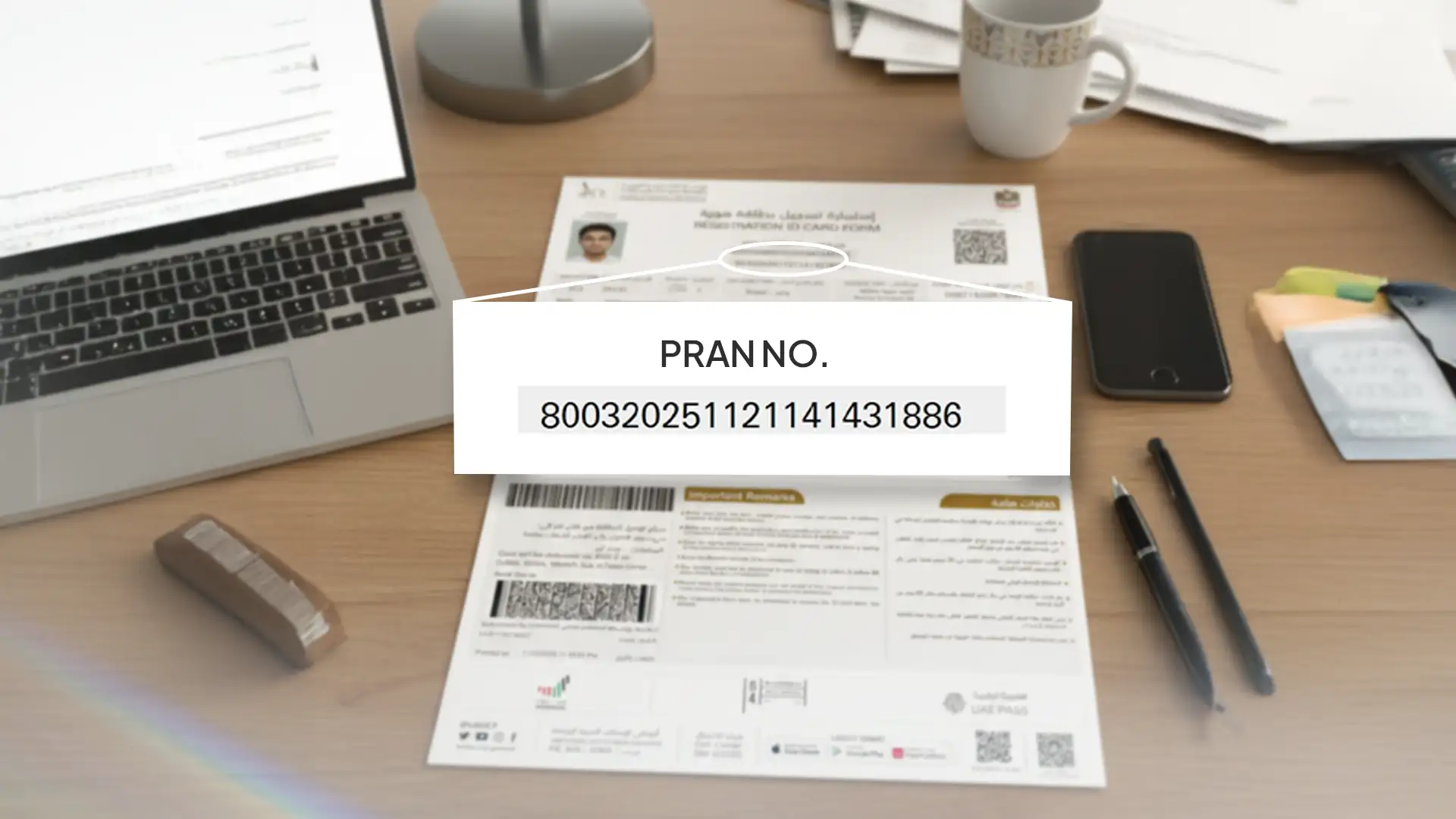

Corporate Tax Registration in the UAE

Every business operating in the UAE must complete corporate tax registration in the UAE, including:

- All mainland and free zone companies

- Freelancers and individuals with commercial licenses

- Even entities with 0% taxable income

At Meydan Free Zone, tax registration is handled as part of the setup process.

Businesses also receive guidance on filing returns, tracking compliance, and maintaining proper accounting records.

FAQs

1. What is the current corporate tax rate in the UAE?

The UAE corporate tax rate is 0% on profits up to AED 375,000 and 9% on profits above that threshold.

2. Do I need to pay corporate tax if I am in a free zone?

If your free zone business qualifies under QFZ rules and is established in Qualified Free Zone like Meydan, you may benefit from a 0% tax rate on qualifying income.

3. Are all businesses required to register for corporate tax?

Yes. All UAE companies, including free zone and small businesses, must register with the FTA.

4. How do I calculate corporate tax in the UAE?

Apply 0% to the first AED 375,000 of taxable profits, and 9% to any amount above that. Free zone businesses may be exempt if they meet qualifying conditions.

5. Is there a corporate tax exemption in the UAE for small businesses?

Yes. Small business relief may be available based on total revenue, subject to FTA

6. What happens if my income includes mainland sales?

Income earned from the mainland may be taxed at 9% unless structured correctly. You must also meet all QFZ conditions to retain 0% on qualifying income.

7. What is the deadline for corporate tax filing?

Filing deadlines depend on your financial year, but annual tax returns are generally due within 9 months from the end of the financial year.

8. Does Meydan Free Zone help with corporate tax compliance?

Yes. Meydan Free Zone guides all license holders through registration, compliance checks, and FTA filing support.

9. Is corporate tax applied to personal income?

No. The UAE does not apply corporate tax to personal salary or wage income. Only business profits are taxable.